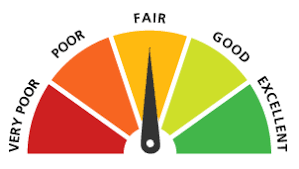

There are two things the general public know about their credit score: it’s either good or bad! After that, the majority of us don’t have a clue about how the system works, how it affects our rating, or what that means for our financial future. If you are like most people, this realization will hit home with some force. The fact that you might be boosting or ruining your rating without knowing it is pretty shocking. Thankfully, you can brush up on your knowledge and learn more about what affects a credit score.

There are two things the general public know about their credit score: it’s either good or bad! After that, the majority of us don’t have a clue about how the system works, how it affects our rating, or what that means for our financial future. If you are like most people, this realization will hit home with some force. The fact that you might be boosting or ruining your rating without knowing it is pretty shocking. Thankfully, you can brush up on your knowledge and learn more about what affects a credit score.

smart debt

Even if you are drowning in debt, the idea of a debt consolidation loan won’t appeal. The reason is the stigma behind the loan itself. Lots of people think there is never a time to consolidate all of their debts into one manageable loan. Why? It’s because you might spend more in the long run, and you stand to be in more debt. However, there are times when debt consolidation is a viable option and is worth considering. If you don’t know what these scenarios are, you can take a look at the following.

Even if you are drowning in debt, the idea of a debt consolidation loan won’t appeal. The reason is the stigma behind the loan itself. Lots of people think there is never a time to consolidate all of their debts into one manageable loan. Why? It’s because you might spend more in the long run, and you stand to be in more debt. However, there are times when debt consolidation is a viable option and is worth considering. If you don’t know what these scenarios are, you can take a look at the following.

Have you got a plan for how you’re going to pay off your student loan debt? If not, it’s probably something that you should start thinking about. It’s not going to go away if you ignore it, so it makes sense to confront it in one way or another. When the sum is so big, it can be pretty daunting, but don’t let that scare you too much. There are always ways to whittle down and eventually pay it off.

Have you got a plan for how you’re going to pay off your student loan debt? If not, it’s probably something that you should start thinking about. It’s not going to go away if you ignore it, so it makes sense to confront it in one way or another. When the sum is so big, it can be pretty daunting, but don’t let that scare you too much. There are always ways to whittle down and eventually pay it off.

Many of us are all too familiar with the weight of credit card debt. American families owe an average of $9,600 on their credit cards, which equates to around 17 percent of the average U.S. household income. Considering today’s steep interest rates and the growing number of Americans with poor credit, we can expect to see this debt grow by thousands each year.

Many of us are all too familiar with the weight of credit card debt. American families owe an average of $9,600 on their credit cards, which equates to around 17 percent of the average U.S. household income. Considering today’s steep interest rates and the growing number of Americans with poor credit, we can expect to see this debt grow by thousands each year.

Your credit score might just be a few numbers on a screen, but it can determine a surprising amount of factors in your life. For example, did you know the following can – and do – check your credit score?

Your credit score might just be a few numbers on a screen, but it can determine a surprising amount of factors in your life. For example, did you know the following can – and do – check your credit score?