Think about this scenario. You’re standing by your car staring at it with a rather forlorn expression on your face. It has a rather ugly dent on it. You have no idea where the dent came from or when it occurred because, as far as you can remember, it wasn’t there this morning.

Think about this scenario. You’re standing by your car staring at it with a rather forlorn expression on your face. It has a rather ugly dent on it. You have no idea where the dent came from or when it occurred because, as far as you can remember, it wasn’t there this morning.

smart debt

A gas credit card will help you track your expenses on fuel as well as increase your savings through rewards and cash back. When selecting a gas credit card there are a few things to bear in mind. This way, you will avoid getting a card that is more expensive to maintain than the rewards you get from it. Secondly, you will get a card that can be used in various outlets hence no need for getting so many cards from different merchants. You should not underestimate your gas expenditures over a long period of time. Getting a gas credit card is one effective way to ensure you save some money on this expensive commodity.

A gas credit card will help you track your expenses on fuel as well as increase your savings through rewards and cash back. When selecting a gas credit card there are a few things to bear in mind. This way, you will avoid getting a card that is more expensive to maintain than the rewards you get from it. Secondly, you will get a card that can be used in various outlets hence no need for getting so many cards from different merchants. You should not underestimate your gas expenditures over a long period of time. Getting a gas credit card is one effective way to ensure you save some money on this expensive commodity.

There is plenty of advice online about how to save money for your household budget. Many experts will make it clear you should stop borrowing, and put aside money for rainy days, build up a good savings account, and free up cash in as many ways as possible.

There is plenty of advice online about how to save money for your household budget. Many experts will make it clear you should stop borrowing, and put aside money for rainy days, build up a good savings account, and free up cash in as many ways as possible.

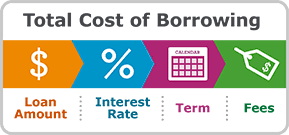

But the reality is that the vast majority of us have to borrow – it’s part of modern life. And for many households, it’s the cost of borrowing that often causes so many financial issues.

Getting into debt is something that could happen to any of us. However, money is often a subject that people don’t want to talk about. Dealing with debt can be challenging and it isn’t something you want to be doing alone, you should talk about it, gather resources and help. Here are 5 tips that will help you deal with your debt. Remember that debt doesn’t need to tear us apart. We can deal with it.

Getting into debt is something that could happen to any of us. However, money is often a subject that people don’t want to talk about. Dealing with debt can be challenging and it isn’t something you want to be doing alone, you should talk about it, gather resources and help. Here are 5 tips that will help you deal with your debt. Remember that debt doesn’t need to tear us apart. We can deal with it.

Money is a subject that most don’t want to talk about. Those who have enough of it don’t need to think about it much and those who don’t have it can think about nothing else! Money is a stressful subject, and we already know that feelings of depression and anxiety are linked to problems with debt.

Money is a subject that most don’t want to talk about. Those who have enough of it don’t need to think about it much and those who don’t have it can think about nothing else! Money is a stressful subject, and we already know that feelings of depression and anxiety are linked to problems with debt.