A tradeline is what banks often call “a line of credit.” The term tradeline refers to any accounts listed on your credit report. Credit cards are one of the most popular tools to build wealth. However, irresponsible people have misused them to accumulate high-interest debts. If you understand the rules, you can use your credit card so that you never run out of funding. Your credit cards and loans are separate tradelines in your credit report. If a creditor buys an account, then a new tradeline is formed. Credit score companies use the tradelines on your credit card to calculate your credit score. If you keep low balances and pay your loans on time, you have a good credit score.

A tradeline is what banks often call “a line of credit.” The term tradeline refers to any accounts listed on your credit report. Credit cards are one of the most popular tools to build wealth. However, irresponsible people have misused them to accumulate high-interest debts. If you understand the rules, you can use your credit card so that you never run out of funding. Your credit cards and loans are separate tradelines in your credit report. If a creditor buys an account, then a new tradeline is formed. Credit score companies use the tradelines on your credit card to calculate your credit score. If you keep low balances and pay your loans on time, you have a good credit score.

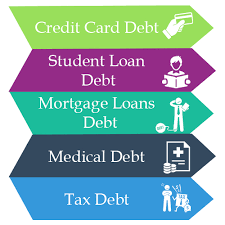

Debt

There are numerous debts that could result in unmanageable stress. It is imperative to identify the different kinds of debts so you can know what each of them involves. If you are unsure of what the different debts involve, you can always seek assistance from a credit counselor to learn about these debts and what they involve. Here are some of the debts you need to know about.

There are numerous debts that could result in unmanageable stress. It is imperative to identify the different kinds of debts so you can know what each of them involves. If you are unsure of what the different debts involve, you can always seek assistance from a credit counselor to learn about these debts and what they involve. Here are some of the debts you need to know about.

Settling your debt can be relieving. Often, you’ll be able to settle for a lesser amount than you owed in the first place, and your new payment plan can be much less stressful on your finances. There are some mistakes that are often made though when people settle their debt, so we’ve created a list of six common mistakes and how you can avoid them.

Settling your debt can be relieving. Often, you’ll be able to settle for a lesser amount than you owed in the first place, and your new payment plan can be much less stressful on your finances. There are some mistakes that are often made though when people settle their debt, so we’ve created a list of six common mistakes and how you can avoid them.

Starting your own business is definitely something worth getting excited about. Maybe you’ve had an awesome business idea that you’re sure is going to go down well, or perhaps you are just fascinated with the idea of starting and growing your own company. Like most new entrepreneurs, you will need to be willing to take some risks such as handing in your notice at your current job, or living on a smaller budget for a while in order to achieve your business goals. But, the only thing holding you back is a lack of capital. You don’t have much money, or the savings that you do have are dedicated to something else. On the surface this can seem like a huge problem, but you don’t have to let it hold you back. Here’s how you can start your own business from scratch, even if you’re broke.

Starting your own business is definitely something worth getting excited about. Maybe you’ve had an awesome business idea that you’re sure is going to go down well, or perhaps you are just fascinated with the idea of starting and growing your own company. Like most new entrepreneurs, you will need to be willing to take some risks such as handing in your notice at your current job, or living on a smaller budget for a while in order to achieve your business goals. But, the only thing holding you back is a lack of capital. You don’t have much money, or the savings that you do have are dedicated to something else. On the surface this can seem like a huge problem, but you don’t have to let it hold you back. Here’s how you can start your own business from scratch, even if you’re broke.

Having debt can steal your peace of mind, especially if it has been pending for too long. For borrowers without a stable source of income, taking out a loan is the surest way of clearing such a debt. However, qualifying for a loan when you already have a pending debt is not a walk in the park. This is because many banks scrutinize all loan applicants just to find an excuse that can justify their decision of denying the loan that you desire so much. Here is a list of tips that can help you in getting yourself out of the dilemma that’s caused by debts.

Having debt can steal your peace of mind, especially if it has been pending for too long. For borrowers without a stable source of income, taking out a loan is the surest way of clearing such a debt. However, qualifying for a loan when you already have a pending debt is not a walk in the park. This is because many banks scrutinize all loan applicants just to find an excuse that can justify their decision of denying the loan that you desire so much. Here is a list of tips that can help you in getting yourself out of the dilemma that’s caused by debts.