For those who have never ventured into the world of credit cards, understanding what they are exactly and what they can mean for your credit score is an important consideration before you go on to submit your application. From understanding the benefits it could bring you, to knowing what you need to repay and when, we’re taking a look at what you need to know about credit cards below.

For those who have never ventured into the world of credit cards, understanding what they are exactly and what they can mean for your credit score is an important consideration before you go on to submit your application. From understanding the benefits it could bring you, to knowing what you need to repay and when, we’re taking a look at what you need to know about credit cards below.

credit score

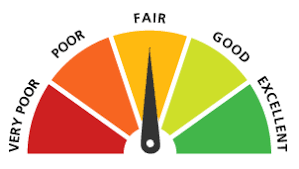

If you are seeking a loan, your credit score will be a determining factor as to whether or not you will be approved. Your credit score is a very important rating that makes you eligible or ineligible for a loan. A credit score is a 3-digit number that is specific to you – taking into account how you’ve dealt with credit in the past.

If you are seeking a loan, your credit score will be a determining factor as to whether or not you will be approved. Your credit score is a very important rating that makes you eligible or ineligible for a loan. A credit score is a 3-digit number that is specific to you – taking into account how you’ve dealt with credit in the past.

Perhaps you’ve been refused credit before based on your financial past, or maybe you’re thinking about making a big purchase and you know you’ll need the help of a lender to do it. Your credit score will be an important factor in your finances for the rest of your life. So, it’s vital that you do what you can to improve your score and put yourself in better financial standing. Here’s what you can do to make sure you’ve got the best score possible.

Perhaps you’ve been refused credit before based on your financial past, or maybe you’re thinking about making a big purchase and you know you’ll need the help of a lender to do it. Your credit score will be an important factor in your finances for the rest of your life. So, it’s vital that you do what you can to improve your score and put yourself in better financial standing. Here’s what you can do to make sure you’ve got the best score possible.

There are two things the general public know about their credit score: it’s either good or bad! After that, the majority of us don’t have a clue about how the system works, how it affects our rating, or what that means for our financial future. If you are like most people, this realization will hit home with some force. The fact that you might be boosting or ruining your rating without knowing it is pretty shocking. Thankfully, you can brush up on your knowledge and learn more about what affects a credit score.

There are two things the general public know about their credit score: it’s either good or bad! After that, the majority of us don’t have a clue about how the system works, how it affects our rating, or what that means for our financial future. If you are like most people, this realization will hit home with some force. The fact that you might be boosting or ruining your rating without knowing it is pretty shocking. Thankfully, you can brush up on your knowledge and learn more about what affects a credit score.

After you file for bankruptcy, it takes time to rebuild your credit, and you might not know where to start. While it might not be easy, it is possible to rebuild your credit after bankruptcy. Here are some tips on how to make it happen:

After you file for bankruptcy, it takes time to rebuild your credit, and you might not know where to start. While it might not be easy, it is possible to rebuild your credit after bankruptcy. Here are some tips on how to make it happen: