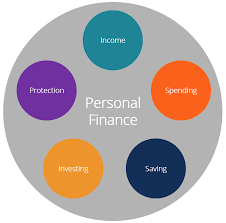

Understanding financial matters is something we all pick up as we go through life, but for some, the gaps in knowledge about certain aspects are wider than with others. Having a basic financial literacy is useful for many reasons and helps us make better decisions when it comes to money. Knowing where to start isn’t always easy, so here are 4 financial topics that you should know more about.

Understanding financial matters is something we all pick up as we go through life, but for some, the gaps in knowledge about certain aspects are wider than with others. Having a basic financial literacy is useful for many reasons and helps us make better decisions when it comes to money. Knowing where to start isn’t always easy, so here are 4 financial topics that you should know more about.

Budgeting

One of the perks of being single is that you can spend most your money on yourself. But you also have sole responsibility for budgeting, investing, saving for a rainy day, and preparing for retirement, since you can’t rely on your partner’s income when times get tough. In this article, we discuss ways for you to manage your finances, achieve your goals, and create a comfortable future.

One of the perks of being single is that you can spend most your money on yourself. But you also have sole responsibility for budgeting, investing, saving for a rainy day, and preparing for retirement, since you can’t rely on your partner’s income when times get tough. In this article, we discuss ways for you to manage your finances, achieve your goals, and create a comfortable future.

Saving money feels good, although it may sound like a lot of work. It becomes all the more important to save every penny you can in the pandemic world when finances are running tight, and things aren’t likely to improve for some time. But you can cut corners here and there to save up an impressive dollar-figure every month. When you start looking for places where you can save on the household budget, you will probably think of food, fuel, and energy expenses first.

Saving money feels good, although it may sound like a lot of work. It becomes all the more important to save every penny you can in the pandemic world when finances are running tight, and things aren’t likely to improve for some time. But you can cut corners here and there to save up an impressive dollar-figure every month. When you start looking for places where you can save on the household budget, you will probably think of food, fuel, and energy expenses first.

The coronavirus pandemic has turned the world around for everyone. We now live in a time marked by social distancing protocols, rolling lock-downs, and increasing financial pressure.

The coronavirus pandemic has turned the world around for everyone. We now live in a time marked by social distancing protocols, rolling lock-downs, and increasing financial pressure.

Those hit by the downturn in the economy have also suffered from pay-cuts, lack of job security, and sometimes, unemployment. This is especially the case for workers in more “COVID-sensitive” industries like the hospitality sector and aviation.

Many of you are already very familiar with the Canadian Emergency Response Benefit (CERB) as it is all over the news right now. If you are currently collecting CERB, there are a few key things that you need to be aware of.

Many of you are already very familiar with the Canadian Emergency Response Benefit (CERB) as it is all over the news right now. If you are currently collecting CERB, there are a few key things that you need to be aware of.