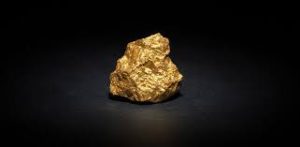

There are many ways to invest money for your future, and precious metals are something that all investors should consider for their portfolios. Precious metals, especially gold, are every so often considered a good hedge against inflation. If you look at their performance over the last decade, they have outperformed stocks and shares. If you are looking to diversify your investment portfolio and add precious metals to it, below are some factors you need to consider before getting started.

There are many ways to invest money for your future, and precious metals are something that all investors should consider for their portfolios. Precious metals, especially gold, are every so often considered a good hedge against inflation. If you look at their performance over the last decade, they have outperformed stocks and shares. If you are looking to diversify your investment portfolio and add precious metals to it, below are some factors you need to consider before getting started.

How Much Should You Invest?

It is a common mistake for new investors to overstretch themselves and invest too heavily in precious metals when they begin. If you are looking to withdraw money out of your current portfolio to make your investment, you should look to invest around 5% of its total worth. As with any other investment, you should only invest what you can afford to lose, although precious metals are a relatively safe investment vehicle. You will also need to consider what type of metals you will invest in for your portfolio.

Which Precious Metals To Invest In?

Many choices are available when looking at the various precious metals you can invest in for your portfolio. The most common precious metals people have in their portfolios are as follows:

- Gold

- Silver

- Platinum

- Palladium

There are also various types of these metals you can own, including bullion, bars, and coins, and all of these can make an excellent investment for you. You will want to look at the market and see how it has performed over the last 12 months and look for any patterns or predictions that may influence precious metals’ value. Once you have decided the type of precious metal you will invest in, you will also need to consider keeping your investment safe and where to do this.

Keeping Your Precious Metal Investment Safe

Unlike investing in stocks and shares, you will need to have somewhere safe and secure to store your precious metals investment. You have various options available, including renting a safety deposit box, holding your investment with a precious metals dealer, and getting a safe in your home. If you keep your investment in your home, you will most likely need a separate insurance policy for it, as your standard cover will not include precious metals. Once you have decided where to keep your investment safe, you will need to find a reputable dealer to purchase your precious metals.

Finding A Reputable Dealer

The next part of the process is to find a reputable and reliable precious metal dealer, and if you can find one close to you, you can avoid delivery charges. There are many excellent dealers. For example, you can buy gold bars at City Gold Bullion. You can make your purchase online and then go to their premises and collect your order if you are close enough to them.

One thing to remember with your precious metal investment is that you should consider it a long-term one. Be prepared to sit on your investment, and you can see it grow significantly over time.

No Comments